8006 Manchester Ave

4 Bedrooms | 2.5 Baths | 2,471sq. ft. →$899,950

MLS #326012331

Jepson Estates subdivision

Cul-de-sac location

10,440 sq ft lot

3 bedrooms

3 full bathrooms

1,685 sq ft

Built 1987

Updated/remodeled

Cathedral ceilings

Brick fireplace

Kitchen island

Gas range

Dishwasher

Microwave

Kitchen/family combo

Walk-in primary closet

Remodeled primary shower

Central heat & air

Dual-pane windows

Covered patio

Patio heaters & fans

Detached 2-car garage

RV possible parking

Tucked into a peaceful cul-de-sac in the desirable Jepson Estates neighborhood, 369 Kendrick Lane offers the kind of versatility today’s buyers rarely find. Situated on a generous 10,440 sq ft lot with mature shade trees, this beautifully updated home blends comfort, flexibility, and thoughtful upgrades in one compelling package.

Inside, cathedral ceilings and bright living spaces create an open, welcoming feel. Newer flooring downstairs adds a fresh, modern touch, while the kitchen is perfectly positioned for both everyday living and entertaining — featuring an island, gas range, dishwasher, microwave, and seamless flow into the family room anchored by a brick fireplace.

Upstairs, the spacious primary suite offers a walk-in closet and a recently remodeled shower, delivering a clean, contemporary retreat. With three full bathrooms and updates throughout, the home reflects pride of ownership at every turn.

Where this property truly stands out is functionality. The attached garage has been converted into a highly usable flex space complete with built-in cabinetry, sink, counter space, and its own A/C unit — ideal for a workshop, gym, creative studio, or home-based business. In addition, a detached 2-car garage offers traditional parking plus RV potential — a rare and valuable feature in established Vacaville neighborhoods.

The backyard is designed for year-round enjoyment, featuring a covered patio with built-in fans and heaters, raised garden beds, and ample space for entertaining or relaxing under mature trees.

This is more than a home — it’s a lifestyle property offering space to live, work, create, and entertain.

Located within the established Jepson Estates subdivision, this area is known for:

Larger lots than newer developments

Quiet interior streets and cul-de-sacs

Mature landscaping

No HOA

Strong pride of ownership

Residents enjoy close proximity to:

Arlington Park

Andrews Park

Alamo Creek Park

The home is served by the respected Vacaville Unified School District.

This location offers that sought-after balance of established neighborhood charm and everyday convenience.

Living at Kendrick Lane means you’re just minutes from:

Interstate 80 access

Nut Tree shopping and dining

Downtown Vacaville

Kaiser and NorthBay medical facilities

Travis Air Force Base

Vacaville’s central positioning between Sacramento and the Bay Area makes it one of Solano County’s most strategic residential hubs.

Vacaville continues to attract buyers seeking space, community, and accessibility. Known for its vibrant downtown, outdoor recreation, and strong local economy, the city offers:

Boutique shopping and dining

Vacaville Premium Outlets

Lagoon Valley Park hiking, biking, and open space

Farmers markets and seasonal events

Easy access to Napa Valley wine country

It’s a city that delivers suburban comfort with regional connectivity — a powerful combination for long-term value.

At Navigate Real Estate, we believe every home deserves to have its story told. To the right, you'll find an interactive digital booklet that brings this property to life. Take the tour and explore every detail-from standout features and modern comforts to the neighborhood amenities that make this area such a great place to call home. Click now to watch the story and see if this could be your next chapter.

Click the image to the right and read this home's story.

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

4 Bedrooms | 2.5 Baths | 2,471sq. ft. →$899,950

4 Bedrooms | 2 Baths | 4,200+ sq. ft. →$1,795,000

4 Bedrooms | 2 Baths | 1,308 sq. ft. →$559,000

3 Bedrooms | 2 Baths | 1,614 sq. ft. →$639,000

3 Bedrooms | 2 Baths | 1,851 sq. ft. →$1,059,000

+/- 20.5 Acres with Buildable Lot $450,000

+/- 2.75 Acre Buildable Lot $175,000

3 Bedrooms | 3.5 Baths | 1,759 sq. ft. →$995,000

2 Bedrooms | 2 Baths | + Loft/Studio | 2,032 sq. ft. →$1,095,000

3 Bedrooms | 2 Baths | 1,428 sq. ft. →$595,000

3 Bedrooms | 2 Baths | 1,608 sq. ft. →$519,000

3 Bedrooms | 2 Baths | 1,148 sq. ft. →$529,000

2 Homes | 5 Beds/3.5Baths | 2,447 →$1,199,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$779,000

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

Some homeowners hesitate to sell because they’ve got unanswered questions that hold them back. But a lot of times their concerns are based on misconceptions, not facts. And if they’d just talk to an agent about it, they’d see these doubts aren’t necessarily a hurdle at all.

If uncertainty is keeping you from making a move, it’s time to get the real answers. The ones you deserve. And to take the pressure off, you don’t have to ask the questions, because here’s the data that answers them.

If you own a home already, you may be tempted to wait because you don’t want to sell and take on a higher mortgage rate on your next house. But your move may be a lot more feasible than you think, and that’s because of how much your house has likely grown in value.

Think about it. Do you know anyone in your neighborhood who’s sold their house recently? If so, did you hear what it sold for? With how much home values have gone up in recent years, the number may surprise you. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), the typical homeowner has gained $147,000 in housing wealth in the last five years alone.

That’s significant – and when you sell, that can give you what you need to fund your next move.

If this is on your mind, it’s probably because you remember just how hard it was to find a home over the past few years. But in today’s market, it isn’t as challenging.

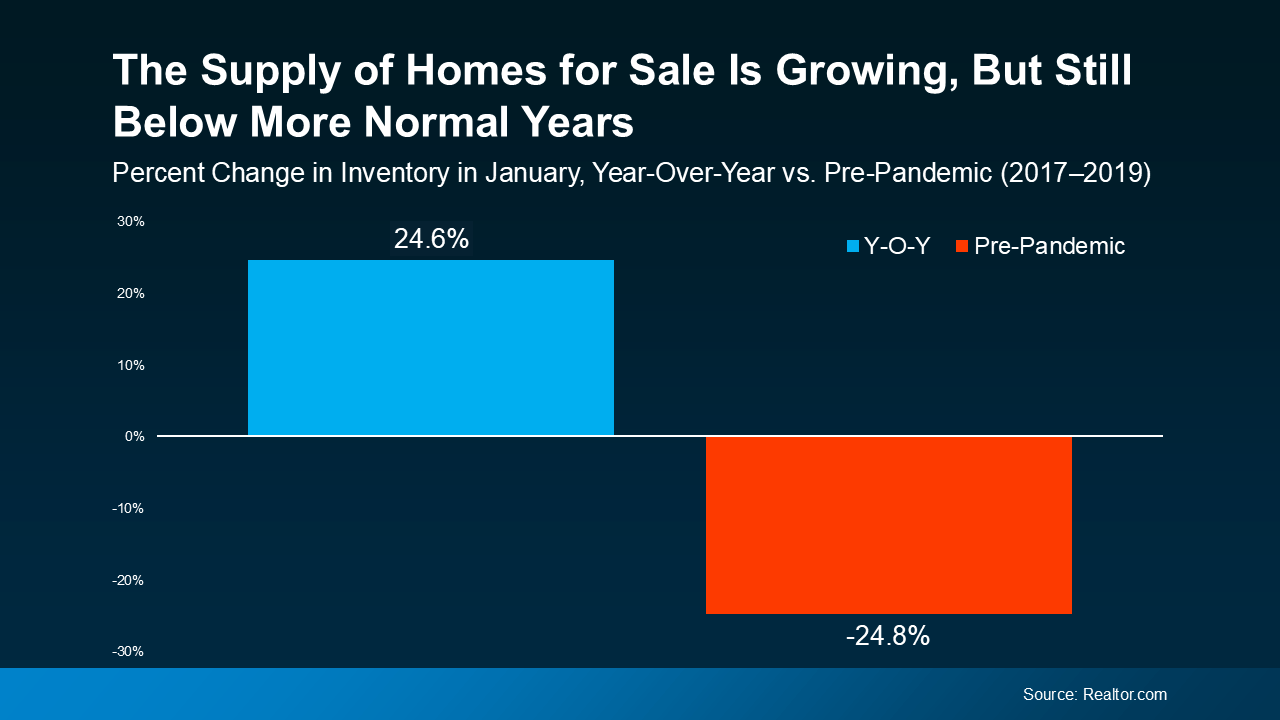

Data from Realtor.com shows how much inventory has increased – it’s up nearly 25% compared to this time last year (see graph below):

Even though inventory is still below more normal pre-pandemic levels, it’s improved a lot in the past year. And the best part is, experts say it’ll grow another 10 to 15% this year. That means you have more options for your move – and the best chance in years to find a home you love.

Even though inventory is still below more normal pre-pandemic levels, it’s improved a lot in the past year. And the best part is, experts say it’ll grow another 10 to 15% this year. That means you have more options for your move – and the best chance in years to find a home you love.

And last, if you’re worried no one’s buying with rates and prices where they are right now, here’s some perspective that can help. While there weren’t as many home sales last year as there’d be in a normal market, roughly 4.24 million homes still sold (not including new construction), according to the National Association of Realtors (NAR). And the expectation is that number will rise in 2025. But even if we only match how many homes sold last year, here’s what that looks like.

Think about that. Just in the time it took you to read this, 8 homes sold. Let this reassure you – the market isn’t at a standstill. Every day, thousands of people buy, and they’re looking for homes like yours.

When you’re ready to walk through what’s on your mind, I have the answers you need. And in the meantime, tell me: what’s holding you back from making your move?

🏠 Some homeowners hesitate to sell because they’ve got unanswered questions that hold them back. But a lot of times their concerns are… Read more….

🏠 Over the past few years, home prices skyrocketed. That’s been frustrating for buyers, leaving many wondering if they’d ever get a shot at owning a home. But here’s some…. Read more….

🏠 Have you been wondering whether you should keep renting or finally make the leap into homeownership?…. Read more….

🏠 It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. …. Read more….

🏠 It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices…Read More

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

4 Bedrooms | 2 Baths | 4,200+ sq. ft. →$1,795,000

4 Bedrooms | 2 Baths | 1,308 sq. ft. →$559,000

3 Bedrooms | 2 Baths | 1,614 sq. ft. →$639,000

3 Bedrooms | 2 Baths | 1,851 sq. ft. →$1,059,000

+/- 20.5 Acres with Buildable Lot $450,000

+/- 2.75 Acre Buildable Lot $175,000

3 Bedrooms | 3.5 Baths | 1,759 sq. ft. →$995,000

2 Bedrooms | 2 Baths | + Loft/Studio | 2,032 sq. ft. →$1,095,000

3 Bedrooms | 2 Baths | 1,428 sq. ft. →$595,000

3 Bedrooms | 2 Baths | 1,608 sq. ft. →$519,000

3 Bedrooms | 2 Baths | 1,148 sq. ft. →$529,000

2 Homes | 5 Beds/3.5Baths | 2,447 →$1,199,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$779,000

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,885 sq. ft. →$675,000

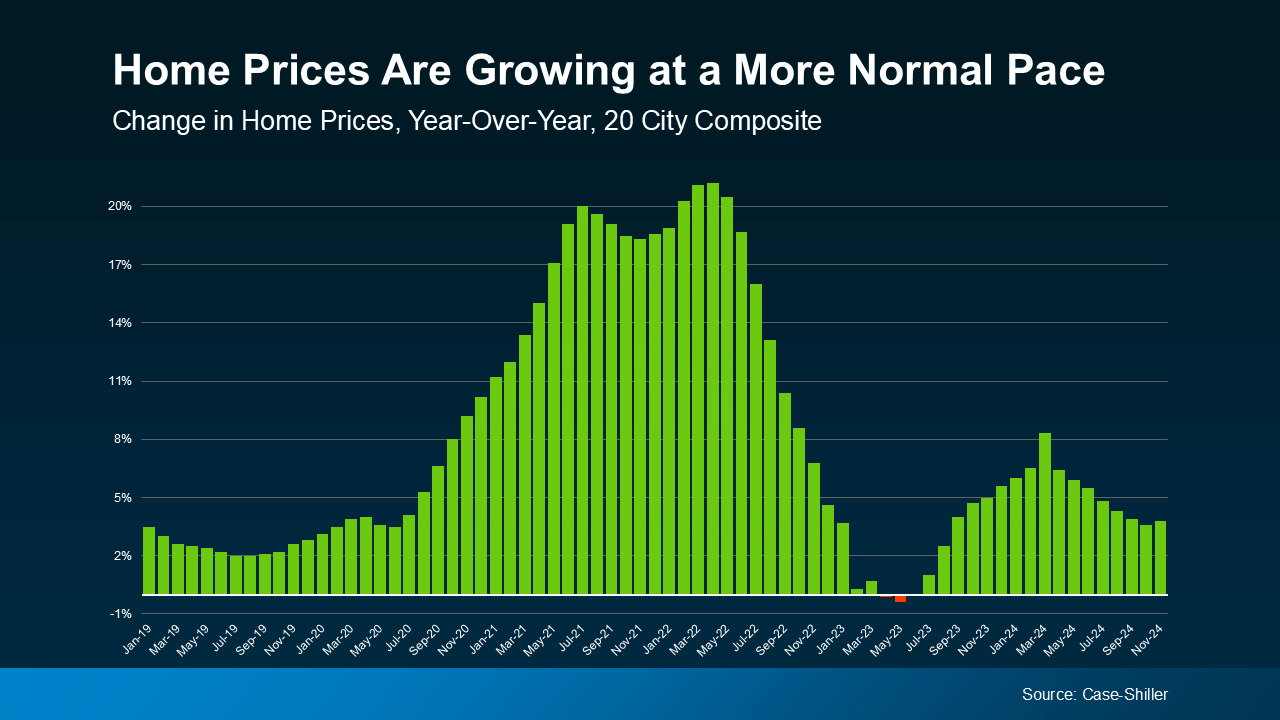

Over the past few years, home prices skyrocketed. That’s been frustrating for buyers, leaving many wondering if they’d ever get a shot at owning a home. But here’s some welcome news: that whirlwind pace of home price growth is slowing down.

At the national level, home prices are still going up, but at a much more moderate, normal pace. For example, in November, the year-over-year increase in home prices was just 3.8% nationally, according to Case-Shiller. That’s a far cry from the double-digit spikes that occurred in 2021 and 2022 (see graph below):

This more normal home price growth might make buying a home feel more attainable for many buyers. You won’t face the same sticker shock or rapid price jumps that made it hard to plan your purchase just a few years ago.

This more normal home price growth might make buying a home feel more attainable for many buyers. You won’t face the same sticker shock or rapid price jumps that made it hard to plan your purchase just a few years ago.

At the same time, steady growth means the home you buy today will likely appreciate in value over time.

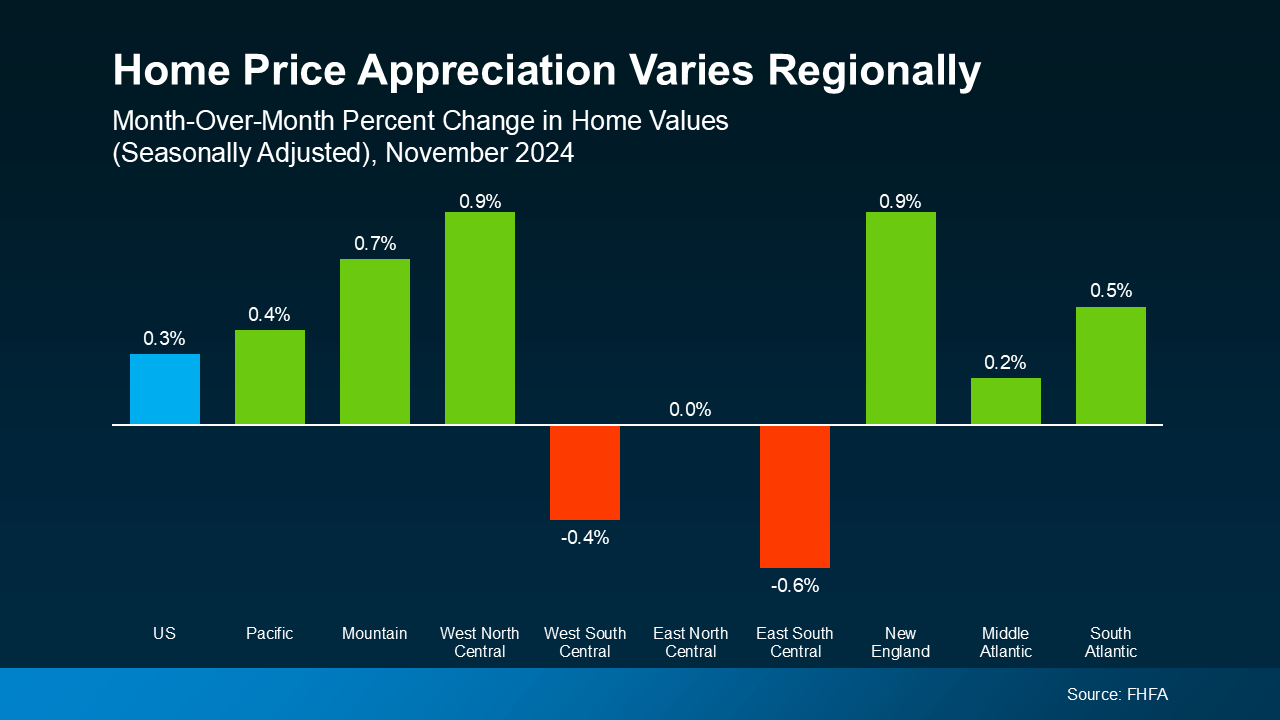

While the national story is one of moderate price growth, it’s important to remember that all real estate is local. Some markets are seeing stronger growth, while others are cooling off or even seeing slight declines. As Selma Hepp, Chief Economist at CoreLogic, notes:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest — remain in high demand and continue to see upward home price pressures.”

Meanwhile, other regions saw slight month-over-month declines in November, according to Federal Housing Finance Agency (FHFA) data (see graph below):

What does this mean for you? It’s crucial to understand what’s happening in your local market. A national average can’t tell the whole story. That’s where working with a local real estate agent can really help. They have the tools and expertise to give you the full picture of what’s happening in your area and how to plan for that in your move.

What does this mean for you? It’s crucial to understand what’s happening in your local market. A national average can’t tell the whole story. That’s where working with a local real estate agent can really help. They have the tools and expertise to give you the full picture of what’s happening in your area and how to plan for that in your move.

Home prices are growing at a more manageable pace, and working with a local real estate agent can help you navigate the ups and downs of your specific market.

How have changing home prices impacted your plans to buy? Let’s talk about it.

🏠 Over the past few years, home prices skyrocketed. That’s been frustrating for buyers, leaving many wondering if they’d ever get a shot at owning a home. But here’s some…. Read more….

🏠 Have you been wondering whether you should keep renting or finally make the leap into homeownership?…. Read more….

🏠 It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. …. Read more….

🏠 It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices…Read More

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

3 Bedrooms | 2 Baths | 1,851 sq. ft. →$1,059,000

+/- 20.5 Acres with Buildable Lot $450,000

+/- 2.75 Acre Buildable Lot $175,000

3 Bedrooms | 3.5 Baths | 1,759 sq. ft. →$995,000

2 Bedrooms | 2 Baths | + Loft/Studio | 2,032 sq. ft. →$1,095,000

3 Bedrooms | 2 Baths | 1,428 sq. ft. →$595,000

3 Bedrooms | 2 Baths | 1,608 sq. ft. →$519,000

3 Bedrooms | 2 Baths | 1,148 sq. ft. →$529,000

2 Homes | 5 Beds/3.5Baths | 2,447 →$1,199,000

4 Bedrooms | 3.5 Baths | 3,454 sq. ft. →$2,500,000

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$779,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

Have you been wondering whether you should keep renting or finally make the leap into homeownership? It’s a big decision, and let’s be real — renting can feel like the easier option, especially if buying a home feels out of reach.

But here’s the thing: a recent report from Bank of America highlights that 70% of prospective buyers fear the long-term consequences of renting, including not building equity and dealing with rising rents.

Maybe you’re feeling that too — concerned about where renting might leave you down the road, but still unsure if you’d even be able to buy right now. The truth is, if you’re able to make the numbers work, buying a home has powerful long-term financial benefits.

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

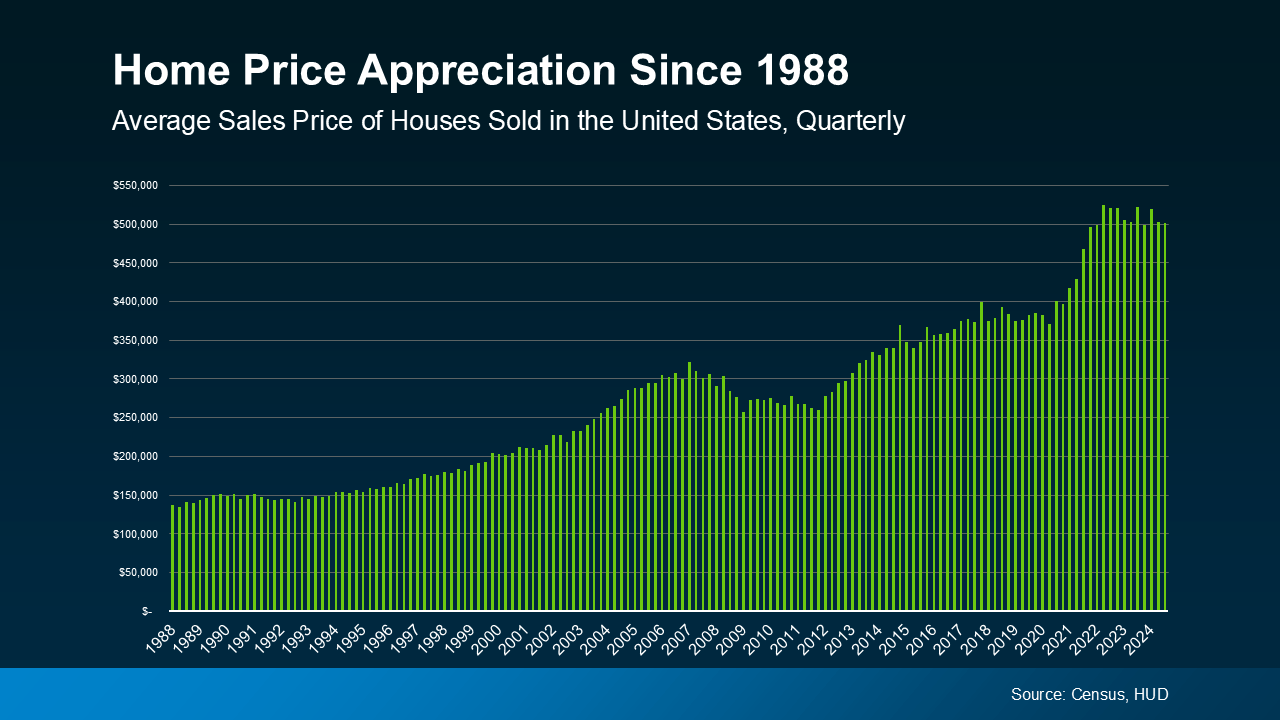

Buying a home allows you to turn your monthly housing costs into a long-term investment. That’s because, as shown in data from the Census and the Department of Housing and Urban Development (HUD), home prices tend to increase over time (see graph below):

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Maybe that’s why, according to the National Association of Realtors (NAR), 79% of buyers believe owning a home is a good financial investment.

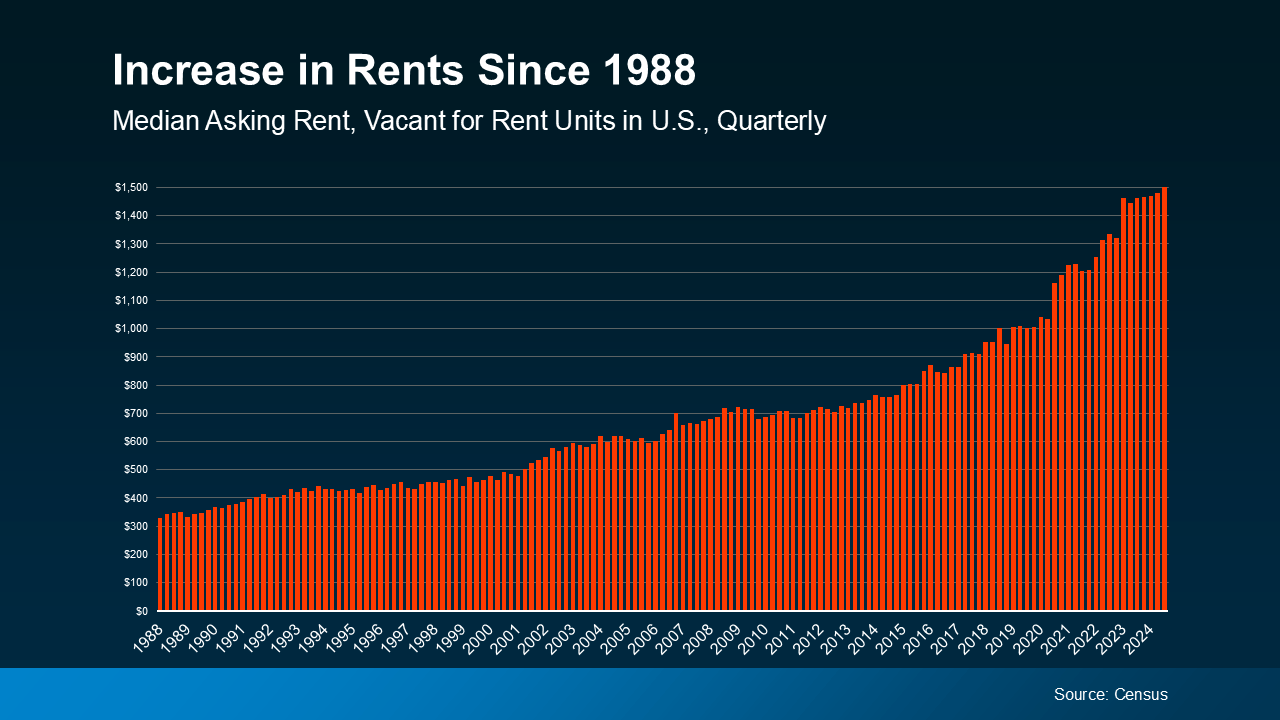

Renting may feel more affordable in the short term, especially right now with today’s home prices and mortgage rates. But the reality is, over time, rent almost always goes up too. Take a look at the data and you can see that play out. According to Census data, rents have significantly increased over the decades (see graph below):

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

When you own a home, your payments are an investment in your future. Renting, on the other hand, means your money is gone for good — it helps your landlord build equity, not you.

Renting works for those not ready (or able) to buy today. But if you are able to make the numbers work, buying a home builds equity and sets you up for long-term financial success. So, even though renting may seem easier now, it can’t match the benefits of homeownership.

If you can afford it, take control of your financial future by making homeownership part of your plan. It’s an investment you won’t regret.

Do you want to see what starter homes are available in our market? Let’s connect today to explore your options.

🏠 Have you been wondering whether you should keep renting or finally make the leap into homeownership?…. Read more….

🏠 It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. …. Read more….

🏠 It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices…Read More

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

3 Bedrooms | 2 Baths | 1,428 sq. ft. →$595,000

3 Bedrooms | 2 Baths | 1,608 sq. ft. →$519,000

3 Bedrooms | 2 Baths | 1,148 sq. ft. →$529,000

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$799,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

2 Bedrooms | 2 Baths | 1,152 sq. ft. →$400,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 3 Baths | 2,415 sq. ft. →$795,000

4 Bedrooms | 2.5 Baths | 2,484 →$1,250,000

3 Bedrooms | 2 Baths | 1,853 sq. ft →$389,000

3 Bedrooms | 2 Baths | 1,350 sq. ft. →$549,997

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

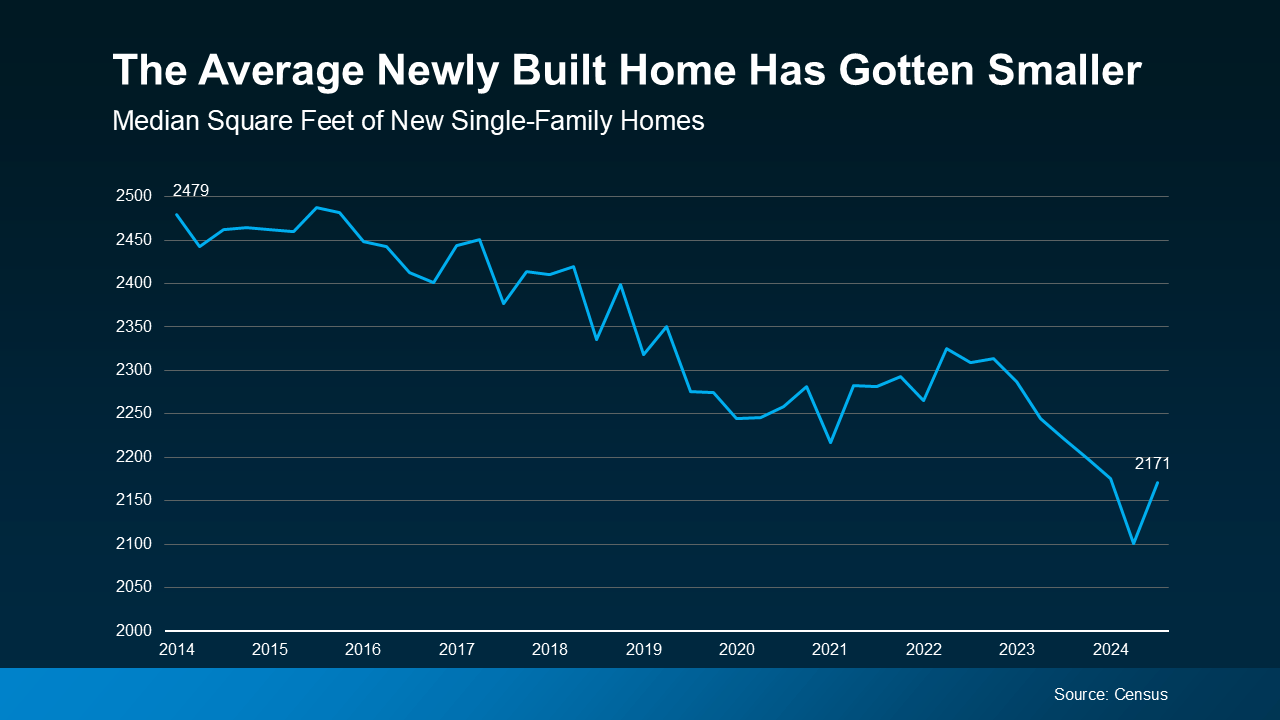

It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more cost-effective options in an unexpected place: new home communities.

Since smaller homes typically come with smaller price tags, buyers have turned their attention to homes with less square footage — and builders have shifted their focus to capitalize on that demand. As U.S. News notes:

“The combination of higher home prices and mortgage rates has strained a lot of people’s budgets. And that’s something builders recognize. To this end, they may be leaning toward smaller spaces . . .That, in turn, can lead to savings for buyers.”

Data from the Census shows the overall builder trend toward smaller, single-family homes has been over the last couple of years (see graph below):

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

At the end of the day, builders want to build what they know will sell. And the number one thing homebuyers are looking for right now is less expensive options to help offset today’s affordability challenges. As Multi-Housing News notes:

“The growing trend toward smaller homes is evident. These homes are less expensive to build and more attainable for many middle-income families, meeting both housing needs and modern lifestyle preferences.”

So, if you’re having trouble finding a home in your budget, it might be worth exploring newly built homes with a smaller footprint.

Not to mention, since newly built homes come with brand new everything, they have fewer maintenance needs and some of the latest features available, like energy-efficient appliances and HVAC. That’ll help you save on repair costs and your monthly utility bills. Sounds like an all-around win.

Today’s builders are focusing their efforts on smaller homes at lower price points. That could give you more opportunity to find something that fits your budget. If you’re planning to buy soon, let’s connect to explore what’s on the market in your area and get your homeownership goals over the finish line.

🏠 It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. …. Read more….

🏠 It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices…Read More

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

🏠 If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your…. Read more….

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$799,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

2 Bedrooms | 2 Baths | 1,152 sq. ft. →$400,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 3 Baths | 2,415 sq. ft. →$795,000

4 Bedrooms | 2.5 Baths | 2,484 →$1,250,000

3 Bedrooms | 2 Baths | 1,853 sq. ft →$389,000

3 Bedrooms | 2 Baths | 1,350 sq. ft. →$549,997

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

4 Bedrooms | 2 Baths | 1,885 sq. ft. →$675,000

4 Bedrooms | 3 Baths | 2,169 sq. ft. →$630,000

3 Bedrooms | 2 Baths | 1,082 sq. ft. →$629,000

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what you need to realize: trying to time the market rarely works. And here’s why.

There is no perfect market.

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing. That’s just the reality of it. If you’re not sure you buy into that, think back to the last 5 years in housing.

Just a few years ago, mortgage rates hit a historic low. To take advantage of that, a ton of buyers rushed to buy a home and lock in those lower rates. The side effect? With such a big increase in how many buyers were purchasing, the homes on the market were snapped up fast. And since that resulted in so few homes left for sale, bidding wars became the norm and home prices went through the roof. Those buyers got a great rate, but they had other things to contend with.

Now, with higher rates and higher prices, it’s more expensive to buy. You can’t argue that. But at the same time, the number of homes for sale is at the highest point in several years. That means you have more options to choose from and you’ll be less likely to find yourself in a pull-out-all-the-stops bidding war. Again, there are benefits and trade-offs in any market.

So, if you have a reason to move and can afford to do so, you’ve got to take advantage of the trends that work in your favor and lean on a pro to help you navigate the rest. As Bankrate says:

“The complexities of the current conditions mean that, now more than ever, it’s smart to lean on the guidance of an experienced local real estate agent. If you want to enter the housing market in 2025, whether as a buyer or a seller, let a pro lead the way for you.”

While achieving your goals may feel like an uphill battle in today’s complex market, it is doable. But you’ll need the help of a trusted real estate agent and a lender.

Your agent will help you explore creative solutions – like looking into different housing types (like smaller condos), considering homes that need a little elbow grease, or casting a wider net for your search area. And your lender will walk you through different loan options and down payment assistance programs, so you know what you need to do to make the numbers work for you. As Yahoo Finance says:

“Buying a house at a time when both mortgage rates and home prices are favorable is a challenge. You probably shouldn’t try to time the housing market . . . Buy when it makes sense for you personally.”

There’s no perfect time to move – every market has its pros and cons. The key is knowing how to make the most of the factors working in your favor. If you need to move and can afford to do it, let’s connect so you’ll have the guidance and tools to make it possible.

🏠 It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices…Read More

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

🏠 If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your…. Read more….

🏠 If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today’s market. Maybe you’re wondering…. Read more….

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$799,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

2 Bedrooms | 2 Baths | 1,152 sq. ft. →$400,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 3 Baths | 2,415 sq. ft. →$795,000

4 Bedrooms | 2.5 Baths | 2,484 →$1,250,000

3 Bedrooms | 2 Baths | 1,853 sq. ft →$389,000

3 Bedrooms | 2 Baths | 1,350 sq. ft. →$549,997

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

4 Bedrooms | 2 Baths | 1,885 sq. ft. →$675,000

4 Bedrooms | 3 Baths | 2,169 sq. ft. →$630,000

3 Bedrooms | 2 Baths | 1,082 sq. ft. →$629,000

Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.

Here are just a few things experts say you should be thinking about as you plan ahead.

Saving for your down payment is likely top of mind. But how much do you really need? A common misconception is that you have to put down 20% of the purchase price. But that’s not necessarily the case. Unless it’s specified by your loan type or lender, you don’t have to. There are some home loan options that require as little as 3.5% or even 0% down. An article from The Mortgage Reports explains:

“The amount you need to put down will depend on a variety of factors, including the loan type and your financial goals. If you don’t have a large down payment saved up, don’t worry—there are plenty of options available . . .”

A trusted lender will go over the various loan types with you, any down payment requirements on those, and down payment assistance programs you may qualify for. The more you know ahead of time, the easier the process will be. And the key to getting the information you need is working with a pro to see what’ll work best for your situation.

Make sure you also budget for closing costs, which are a collection of fees and payments made to the various parties involved in your transaction. Bankrate explains:

“Mortgage closing costs are the fees associated with buying a home that you must pay on closing day. Closing costs typically range from 2 to 5 percent of the total loan amount, and they include fees for the appraisal, title insurance and origination and underwriting of the loan.”

When it comes to closing costs, a trusted lender can guide you through specifics and answer any questions you may have. They can also give you a better idea of how much you should be prepared to pay so you can cruise through your closing with confidence.

And as you plan ahead for closing day, be sure to budget for your real estate agent’s professional service fee too, in case the seller doesn’t cover it. But don’t worry, you’ll work with your agent ahead of time to agree on what this is, so you won’t be surprised at the finish line.

And if you want to cover all your bases, you can also consider saving for an earnest money deposit (EMD). According to Realtor.com, an EMD is typically between 1% and 2% of the total home price and is money you pay as a show of good faith when you make an offer on a house.

But, it’s not an added expense. Instead, it works like a credit and goes toward some of your upfront costs. You’re simply using some of the money you’ve already saved for your purchase to show the seller you’re committed and serious about buying their house. Realtor.com describes how it works as part of your sale:

“It tells the real estate seller you’re in earnest as a buyer . . . Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront.”

Keep in mind, this isn’t required, and it doesn’t guarantee your offer will be accepted. It’s important to work with a real estate advisor to understand what’s best for your situation and any specific requirements in your local area. They’ll advise you on what moves you should make so you can make the best possible decisions throughout the buying process.

The key to a successful homebuying savings strategy? Being informed about what you need to save for. Because, when you understand what to expect, you can plan ahead. With an expert agent and a trusted lender, you’ll have the information you need to move forward with confidence.

🏠Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.…. Read more….

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

🏠 If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your…. Read more….

🏠 If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today’s market. Maybe you’re wondering…. Read more….

🏠 Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth…. Read more….

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$799,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

2 Bedrooms | 2 Baths | 1,152 sq. ft. →$400,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 3 Baths | 2,415 sq. ft. →$795,000

4 Bedrooms | 2.5 Baths | 2,484 →$1,250,000

3 Bedrooms | 2 Baths | 1,853 sq. ft →$389,000

3 Bedrooms | 2 Baths | 1,350 sq. ft. →$549,997

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

4 Bedrooms | 2 Baths | 1,885 sq. ft. →$675,000

4 Bedrooms | 3 Baths | 2,169 sq. ft. →$630,000

3 Bedrooms | 2 Baths | 1,082 sq. ft. →$629,000

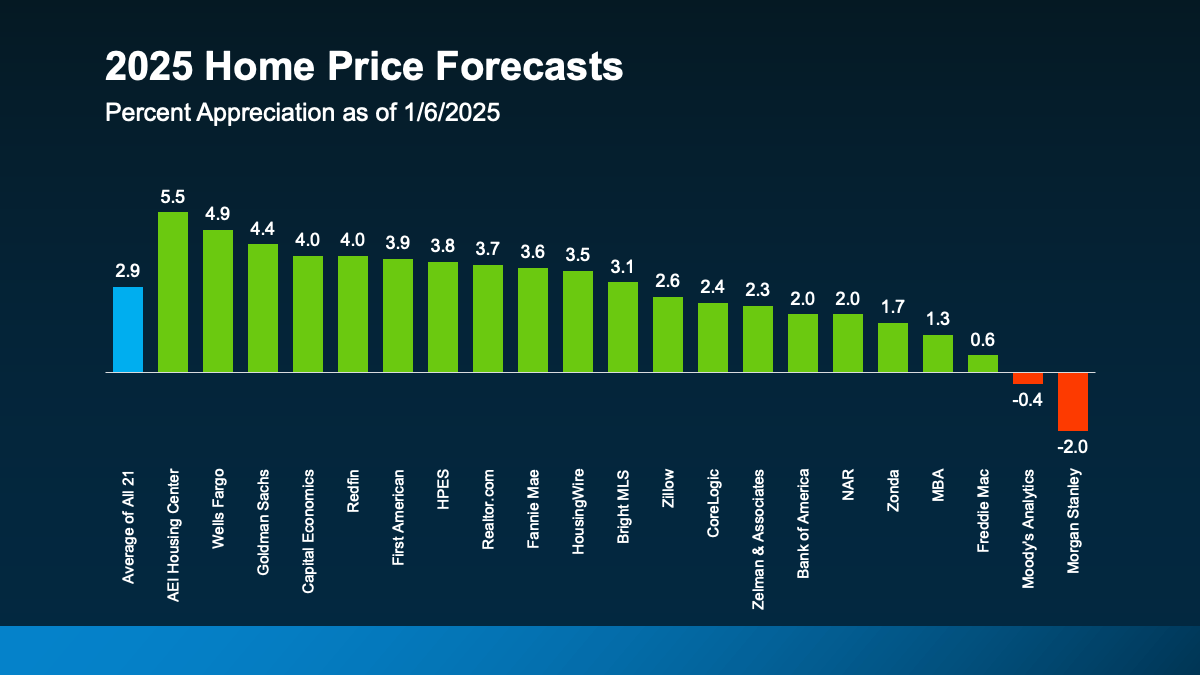

Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.

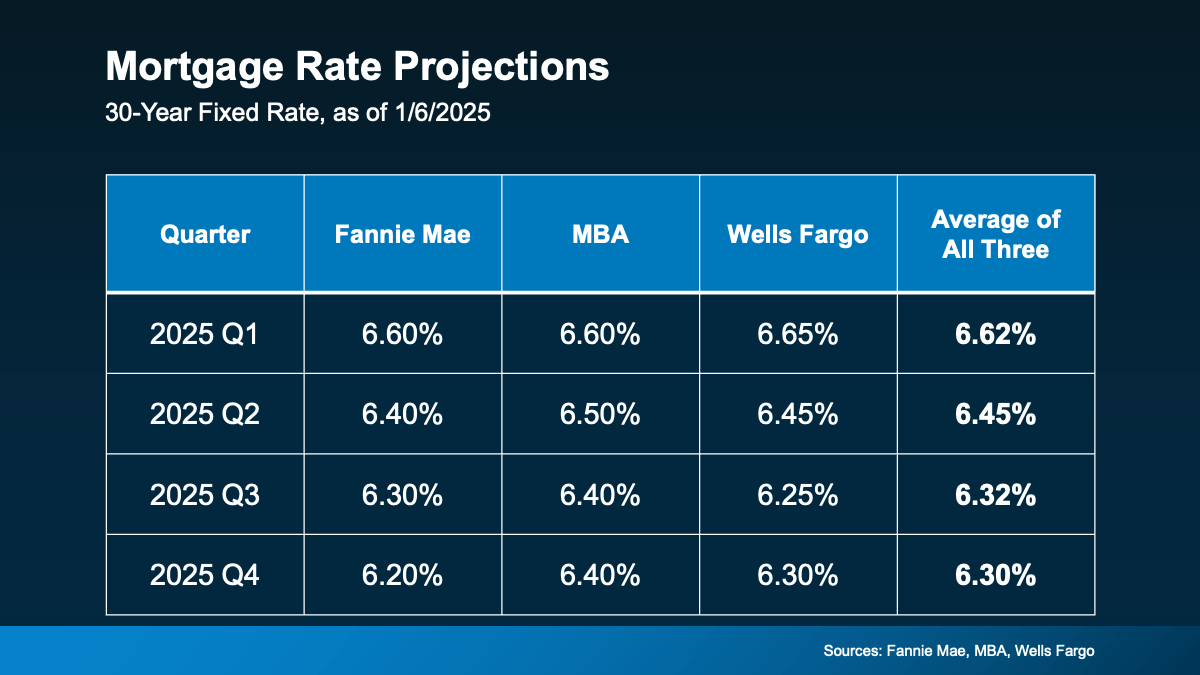

Experts are constantly updating and revising their forecasts, so here’s the latest on two of the biggest factors expected to shape the year ahead: mortgage rates and home prices.

Everyone’s keeping an eye on mortgage rates and waiting for them to come down. So, the question is really: how far and how fast? The good news is they’re projected to ease a bit in 2025. But that doesn’t mean you should expect to see a return of 3-4% mortgage rates. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

And the other experts agree. They’re forecasting rates could settle in the mid-to-low 6% range by the end of the year (see chart below):

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

A trusted lender and an agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your bottom line. With their help, you’ll see even a small decline can help bring down your future mortgage payment.

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – just at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. And that’s a much more typical and sustainable rise in prices (see graph below):

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

And if you’re wondering how it’s even possible prices are still rising, here’s your answer. It all comes down to supply and demand. Even though there are more homes for sale now than there were a year ago, it’s still not enough to keep up with all the buyers out there. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind, though, the housing market is hyper-local. So, this will vary by area. Some markets will see even higher prices. And some may see prices level off or even dip a little if inventory is up in that area. In most places though, prices will continue to rise (as they usually do).

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends and what they mean for your plans.

The housing market is always shifting, and 2025 will be no different. With rates likely to ease a bit and prices rising at a more normal and sustainable pace, it’s all about staying informed and making a plan that works for you.

Let’s connect so you can get the scoop on what’s happening in our area and advice on how to make your next move a smart one.

🏠Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home?…. Read more….

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

🏠 If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your…. Read more….

🏠 If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today’s market. Maybe you’re wondering…. Read more….

🏠 Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth…. Read more….

🏠No one likes making mistakes, especially when they happen in what’s likely the biggest transaction of your life – buying a home. That’s why partnering with a trusted agent is so important. Here’s a sneak peek at the most…Read More

Our in house marketing team of designers, analysts, artists and technology gurus are constantly offering strategically driven marketing solutions and custom tailored work to meet the individual needs of our clients.

FREE Home Valuation

FREE Buyer Resources

+1 707.580.3499

3 Bedrooms | 2 Baths | 2,400 sq. ft. →$2,500,000

5 Bedrooms | 4 Baths | 4,100+ sq. ft. →$2,495,000

4 Bedrooms | 2 Baths | 1,587 sq. ft. →$899,000

5 Bedrooms | 3.5 Baths | 3,574 sq. ft. →$2,275,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$799,000

4 Bedrooms | 2.5 Baths | 2,299 sq. ft. →$769,950

3 Bedrooms | 2 Baths | 1,475 sq. ft. →$581,000

3 Bedrooms | 2 Baths | 1,435 sq. ft. →$619,000

3 Bedrooms | 2.5 Baths | 1,424 sq. ft. →$425,000

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

2 Bedrooms | 2 Baths | 1,152 sq. ft. →$400,000

2 Bedrooms | 1 Baths | 1,120 sq. ft. +/-43 Acres →$385,000

4 Bedrooms | 3 Baths | 2,415 sq. ft. →$795,000

4 Bedrooms | 2.5 Baths | 2,484 →$1,250,000

3 Bedrooms | 2 Baths | 1,853 sq. ft →$389,000

3 Bedrooms | 2 Baths | 1,350 sq. ft. →$549,997

4 Bedrooms | 2 Baths | 1,304 sq. ft. →$515,000

4 Bedrooms | 2 Baths | 1,885 sq. ft. →$675,000

4 Bedrooms | 3 Baths | 2,169 sq. ft. →$630,000

3 Bedrooms | 2 Baths | 1,082 sq. ft. →$629,000

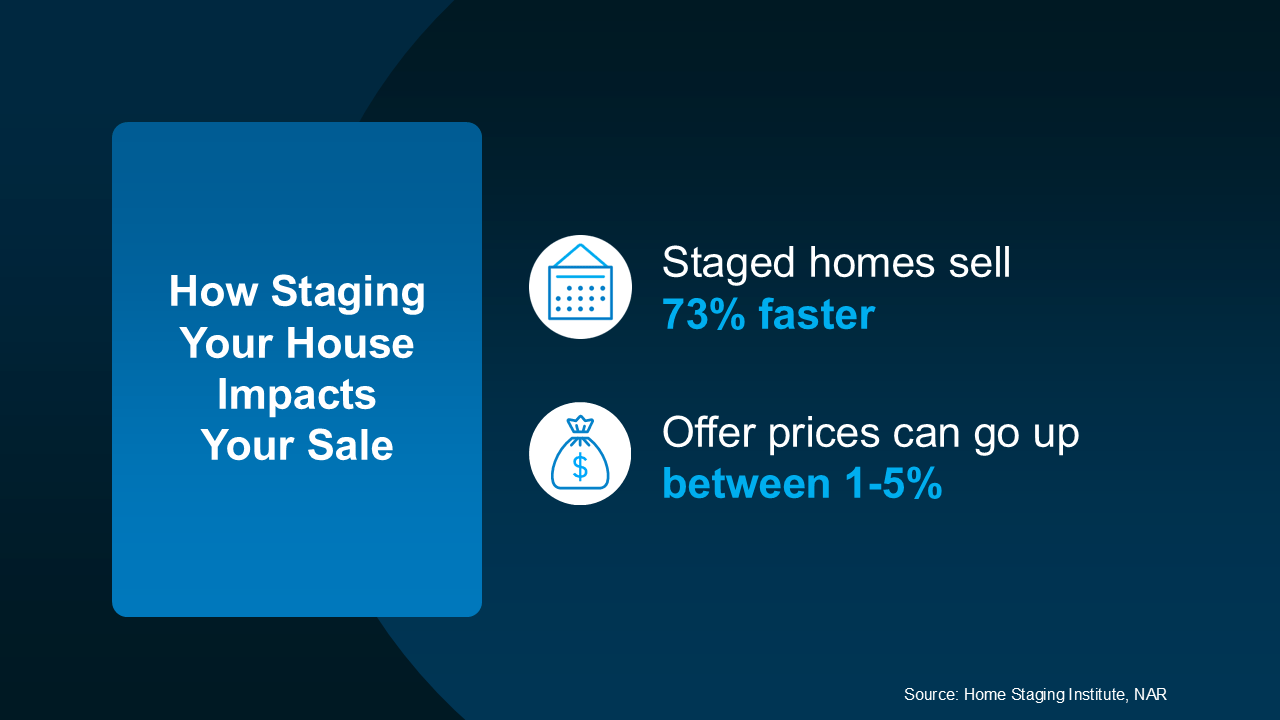

You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?

Here are a few quick FAQs that can help you decide how much you should prioritize staging as you prep for your move.

Staging is the process of arranging and decorating your house to highlight its best features and make it as appealing as possible to potential buyers. It can range from simple touch-ups to more extensive setups, depending on your needs and budget.

Studies show good staging does have an impact on your sale. Staging your house well can help you attract more attention from buyers, which ultimately helps it sell faster and maybe for a higher price than an unstaged home (see visual):

What Are My Staging Options?

What Are My Staging Options?Now that you see the value, let’s think through your options. The most common is leaning on your agent for their expert advice. They know what buyers like because they’re in showings all the time and hear that feedback first-hand. That expertise is crucial to getting your house market-ready. Basic staging with an agent usually means they give you insight into how you should:

Full-service staging is another option if your house needs more hands-on attention. This is when you hire a staging professional or staging company to come in, make recommendations, and do the work for you. Going this route is more involved and that makes it more costly too. That’s because it can include renting furniture and decor to more fully transform a space.

Not sure which one you need? You don’t have to figure that out on your own. Your real estate agent will help determine what level of staging will make the most impact on your house and market.

They can help you decide if professional staging is worth the investment, or if you can knock it out with their advice alone. And just so you know, here are some of the factors an agent will look at to figure that out:

Staging your house properly can make it much more attractive to buyers, but it’s not a one-size-fits-all solution, and every home shines differently. Let’s connect to talk through what your home really needs to stand out and sell for top dollar.

🏠 You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?…. Read more….

🏠 When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home…Read More

🏠 Today’s mortgage rates and home prices may have you second-guessing whether it’s still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider…. Read more….

🏠 If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your…. Read more….

🏠 If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today’s market. Maybe you’re wondering…. Read more….

🏠 Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth…. Read more….

🏠No one likes making mistakes, especially when they happen in what’s likely the biggest transaction of your life – buying a home. That’s why partnering with a trusted agent is so important. Here’s a sneak peek at the most…Read More

🏠Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from. So, know that if you’ve got moving on your mind,…Read More